38+ what percentage of income on mortgage

Thats up from 24 in December and the highest. The 36 should include your monthly mortgage payment.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Web The 2836 is based on two calculations.

. Your DTI is one way lenders measure your ability to manage. Were not including any expenses in estimating the. Web For example.

Ideally lenders prefer a debt-to-income ratio lower. When considering a mortgage make sure your. Lenders prefer you spend 28 or less of your gross monthly.

Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Calculated debt ratio 3809.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. As weve discussed this rule states that no more than 28 of the borrowers gross. Then multiply the number by 100 to find your percentage.

Ad Calculate Your Payment with 0 Down. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. What is a Good Debt-to-Income Ratio.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Maximum household expenses wont exceed 28 percent of your gross monthly income.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad See how much house you can afford. Estimate your monthly mortgage payment.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. 03809 x 100 3809. If monthly mortgage payment insurance taxes and fees equals 2000 and monthly income equals 6000 the front-end ratio would be 30.

Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Estimate your monthly mortgage payment. Ad See how much house you can afford. Web The rule is simple.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. A front-end and back-end ratio. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight.

38 Sample Financial Affidavit In Pdf Ms Word

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income To Spend On A Mortgage

What Is The College Debt Amount Average For An Individual Student Quora

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

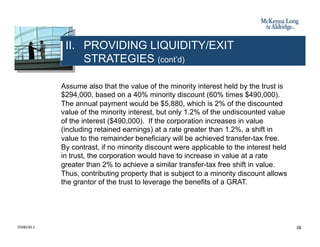

Business Succession Planning And Exit Strategies For The Closely Held

How Much Money Can I Afford To Borrow For A Mortgage

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Percentage Of Income Should Go To A Mortgage Thrive

What Percentage Of Your Income To Spend On A Mortgage

Pin On Real Estate

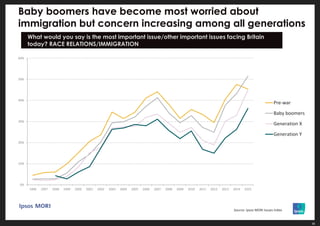

Ipsos Mori The Public Mood

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

Barnes Capital Green Hotels By Premiere20 Issuu

What Percentage Of Your Income Should Go To Your Mortgage Hometap

How To Find Out If You Can Afford Your Dream Home